UK Banking onboarding

Improving United Kingdom banking startup customer onboarding process. Onboarding key metrics increased and helped company save money, save compliance team time and off course user experience became better Current design

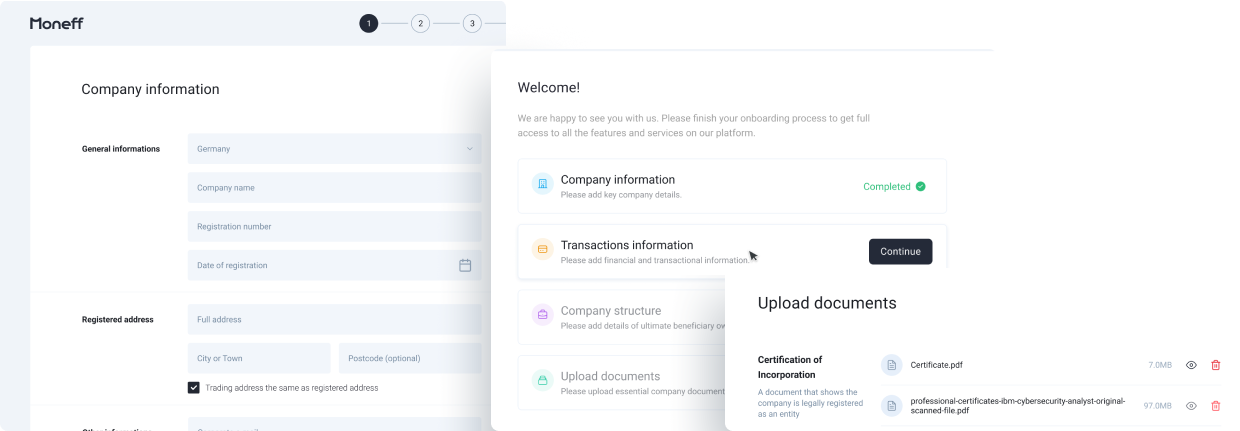

Current design

About project

Moneff is fintech company in the United Kingdom. Main products are multicurrecy bank accounts, FX

and merchant.

Moneff is the one-stop hub for small business owners. We enable SMEs and sole traders to move their

money efficiently by offering free multi-currency business accounts (subject to eligibility),

transfers with competitive FX rates, card issuing and online payment processing services.

Initial assumption

- Link sample. Clients are not happy that the process of opening an account takes a long time

- The user is not aware of the status of the application

- Support is bombarded with letters.

- Clients want to know the status of an application and when their applications will be considered.

Research and and methods to get more data

- Compiled questions and conducted high-quality interviews with colleagues from the compliance department. It is they who process the data of future potential customers

- Link sample line The support team also conducted an interview

- The method of interviewing colleagues was chosen because of the problem in data processing. It is the colleagues who process the questionnaires.

Main finding from research data

- Compliance department lacks the primary data that we receive from the application on the site. Their pain is that then each time you need to write an e-mail message to the client asking for additional data. Clients do not respond quickly or send incorrect documents. As a result, it takes time to open an account.

- From start to account opening takes 10 days.

- The account is opened in the UK. There is a regulator in the face of the FCA. He has a big requirement for those who want to open an account.

- I saw a list of data that the regulator requires to open an account. Got a mild shock. There is a lot to ask.

- Due to the fact that the form is easy and potential clients think that it is easy to open an account in the UK. About 60% of requests to open an account do not meet the requirement. It turns out that the compliance loses 60% of the time for processing applications that do not meet the requirements and are abandoned to users

Main goal

- Improve the registration form, thereby reducing the burden on compliance

- Reduce the number of requests to the support team

Moneff is fintech company in the United Kingdom. Main products are multicurrecy bank accounts, FX and merchant. Moneff is the one-stop hub for small business owners. We enable SMEs and sole traders to move their money efficiently by offering free multi-currency business accounts (subject to eligibility), transfers with competitive FX rates, card issuing and online payment processing services.

Solution

Metrics or what changed to good way

- Compliance planned to hire another assistant to help with applications. With saved N amount money.

- The load on compliance has fallen. 10% of incoming applications do not meet the requirement.

- The load on the support team has fallen. If earlier the number of letters per week was 50 and now 10 letters per week regarding applications and registration.

Team

- Lead Product Designer: Farkhod Saydullaev

- Product Designer: Daria Zubarevich

- UX copywriter: Lala Cooper

- Graphic designer: Timur Hayrulin

Conclusion

Nothing ideal. Each product can be improved better then previos day. With our team we will improve our onborading and step by step.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Harum, amet?